Get Funding

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed gravida nisi id metus lacinia, quis finibus neque laoreet.

Embarking on the adventure of starting and running a small business is a thrilling experience. The excitement of bringing a vision to life, coupled with the freedom to be your own boss, is unparalleled. However, this journey is also laden with countless decisions that can determine the trajectory of your business. Among these, one of the most critical – and often underestimated – aspects is banking. Effective financial management is not just about maintaining your operations; it’s about ensuring your business thrives and grows.

In this guide, we’ll dive into the essentials of small business banking and highlight key points every small business owner should know.

The Crucial Role of Banking in Small Business Success

Financial Health and Stability

Your business’s financial health is the backbone of its operations. A well-structured banking system allows you to manage cash flow, handle transactions smoothly, and plan for the future. Without effective financial management, even the most promising business ideas can falter. For instance, if you don’t have a clear picture of your cash flow, you might struggle to pay suppliers on time or miss opportunities for investment and growth.

Access to Essential Services

Banks offer a variety of services beyond just holding your money. These services include credit card processing, loans and lines of credit, payroll management, and financial planning tools. Access to these services can streamline your operations and provide the necessary funds to seize growth opportunities or weather difficult times.

Professionalism and Credibility

Having a dedicated business bank account adds a layer of professionalism to your enterprise. It shows clients, vendors, and potential investors that you are serious and organized. This professional approach can enhance your credibility and help build trust, which is crucial in establishing long-term business relationships.

Financial Planning and Growth

Banking isn’t just about managing the present; it’s about planning for the future. Whether you’re saving for a significant investment, planning for seasonal fluctuations in revenue, or seeking funding for expansion, having a solid banking relationship is essential. Banks can offer financial advice, investment products, and loan options tailored to your business’s needs and goals.

Choosing the Right Bank

The foundation of your business’s financial management begins with selecting the right bank. The right bank can offer the necessary support, services, and resources tailored to your business’s specific needs, facilitating smoother transactions, effective cash management, and strategic financial planning. Here’s what to consider:

Bank Size and Specialization

Consider the strengths and specializations of large national banks and smaller community banks/credit unions:

Large National Banks

Large national banks typically have vast resources and an extensive network of branches and ATMs, making them convenient if your business operates in multiple locations. They often offer a comprehensive suite of services including sophisticated online banking platforms, extensive loan products, and specialized services like international banking or treasury management. Large banks tend to lead in technological advancements, providing cutting-edge tools and platforms for digital banking, mobile apps, and payment solutions.

Smaller Community Banks and Credit Unions

Smaller banks and credit unions are often known for their personalized service and local knowledge. They are more likely to offer customized solutions tailored to your specific business needs and are more flexible in their decision-making processes. These institutions tend to have a strong focus on local businesses and may be more willing to invest in your community’s growth. They often provide a sense of community and familiarity that larger banks may lack.

At smaller banks, you’re more likely to build relationships with senior staff or decision-makers who understand your business on a personal level, which can be advantageous when you need quick decisions on loans or other services.

Fees and Charges

Compare the fee structures of different banks. Look for accounts with low or no fees for services you’ll frequently use, such as deposits, withdrawals, and wire transfers.

Services Offered

When selecting a bank for your small business, it’s crucial to consider the range of services they offer. Your bank should provide not only the basic financial products but also advanced solutions that can cater to your specific operational needs and growth aspirations.

Customer Service

When it comes to choosing a bank for your small business, customer service is more than just a convenience – it’s a critical factor that can significantly impact your daily operations and overall experience. A bank that offers exceptional customer support can provide the reassurance and assistance you need to navigate financial challenges and make informed decisions.

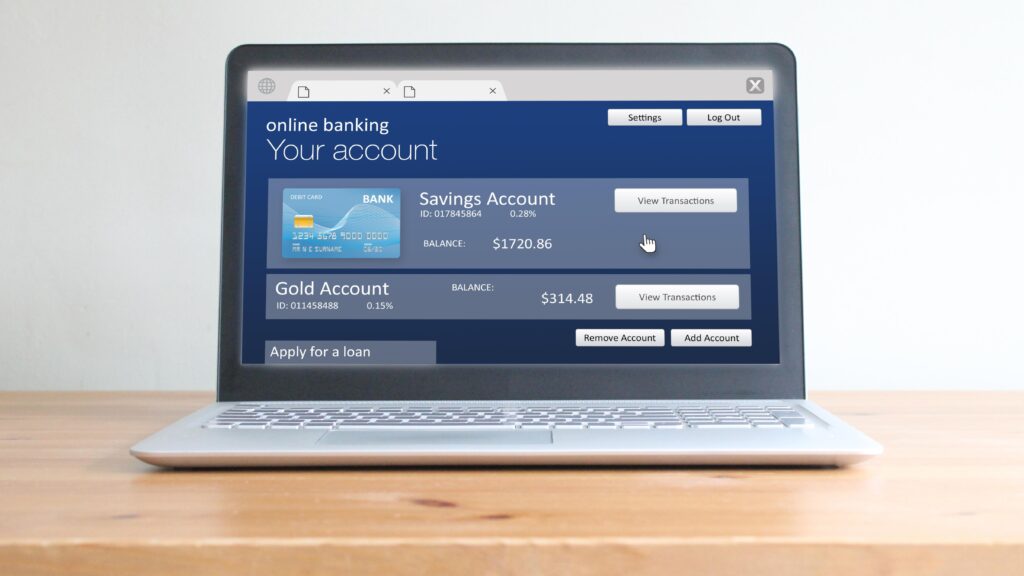

Understanding Different Account Types

When it comes to managing your small business’s finances, selecting the right types of bank accounts is essential. Each account type offers unique features and benefits tailored to different aspects of your financial operations. By understanding the various account options available, you can optimize your financial management, streamline your processes, and support your business’s growth. Here’s a closer look at the different types of accounts you should consider:

Business Checking Account

This is the backbone of your business’s day-to-day operations. It’s used for managing cash flow, paying bills, and making deposits. Look for accounts that offer features like unlimited transactions or minimal fees.

Business Savings Account

Designed to help you save for future expenses, emergencies, or growth opportunities. They provide a safe place to store funds while earning interest. These accounts typically offer interest on the balance, allowing your money to grow over time. The interest rates vary, so it’s important to compare options to maximize your returns. While savings accounts aren’t meant for daily transactions, they offer liquidity, enabling you to transfer funds to your checking account when needed.

Merchant Services Account

If your business accepts credit card payments, you’ll need this type of account. It handles processing and settling credit card transactions, and it’s vital for e-commerce or retail businesses.

Credit Lines and Loans

These accounts provide access to funds for expansion, purchasing inventory, or managing cash flow gaps. Establishing a relationship with your bank can facilitate obtaining these financial products.

The Importance of Separating Personal and Business Finances

As a small business owner, maintaining a clear separation between your personal and business finances is not just a matter of best practice – it’s a foundational element for the long-term health and success of your business. This distinction is crucial for a variety of reasons, each contributing to smoother operations, better legal protection, tax efficiency, and enhanced professional credibility.

Legal Protection

Separating your personal and business finances is crucial for protecting your personal assets from being at risk due to business-related legal actions or debts. This separation is especially important for business structures like corporations or LLCs that are designed to provide personal liability protection. Mixing finances can lead to “piercing the corporate veil,” where courts may hold you personally liable for business obligations.

Additionally, maintaining distinct accounts simplifies managing business insurance claims and enhances your ability to assess and mitigate financial risks specific to your business, ensuring your personal finances remain secure and untangled from your business operations.

Tax Efficiency

Clear distinction enhances tax efficiency and streamlines bookkeeping by ensuring accurate financial records and simplifying tax preparation. This distinction reduces errors, aids in tracking deductible expenses, and minimizes the risk of IRS scrutiny, thus ensuring compliance with tax regulations. It also makes it easier to claim eligible business deductions and credits, leading to potential tax savings. Furthermore, having distinct financial records supports effective tax planning strategies and allows for better collaboration with tax professionals to optimize tax advantages.

Professionalism

Maintaining a dedicated business account enhances professionalism, projecting a credible image to clients, suppliers, and investors, and instilling trust and confidence in stakeholders by demonstrating sound financial management. This professional approach improves vendor relations, as vendors are more likely to offer favorable terms and credit. It also facilitates business growth by providing clear financial documentation, which is essential for securing loans and attracting investors.

Separate accounts simplify financial management by making cash flow easier to monitor, aiding in effective budgeting and forecasting, and streamlining financial reporting. Furthermore, they ensure compliance with regulatory requirements, prevent fraud, and enhance internal controls and accountability.

Common Oversights in Small Business Banking

Many new entrepreneurs underestimate the importance of establishing a proper banking system for their business. Neglecting this crucial step can lead to various complications that can hinder the growth and success of the business. Here are some common oversights:

Mixing Personal and Business Finances

One of the most frequent mistakes is not separating personal and business finances. This can lead to disorganized financial records, making it challenging to track expenses, manage cash flow, and prepare accurate financial statements.

Choosing the Wrong Bank

Not all banks are created equal, and not every bank is suited for every business. Selecting the wrong bank can lead to a myriad of issues, from insufficient services to unexpected fees and poor customer support. Therefore, it’s crucial to thoroughly research and find a bank that aligns with your specific business needs. Consider the range of services they offer, the structure of their fees, the quality of their customer support, and how well they can accommodate the unique demands of your business. Making an informed decision will help ensure a smooth and supportive banking relationship.

Neglecting Cash Flow Management

Without clear cash flow management, businesses may struggle to cover expenses during slow periods and miss growth opportunities. Effective cash flow management ensures liquidity, financial stability, and long-term growth.

Overlooking Technological Tools

Many small businesses don’t fully utilize the technological tools and integrations available through their banks. By neglecting these resources, businesses miss out on opportunities to enhance efficiency, improve financial oversight, and gain deeper insights into their financial health. Embracing these technological advancements can lead to better decision-making, reduced administrative burdens, and a more competitive edge in the market.

Ignoring the Relationship Aspect

Building a strong rapport with your bank offers personalized support, tailored advice, and unique resources. These relationships lead to better financial solutions, guidance during economic shifts, and strategic partnerships for mutual growth. Nurture these connections to strengthen your business’s resilience and stability.

Leveraging Financial Tools and Technology

Modern banking encompasses more than traditional checking and savings accounts. By embracing and leveraging the latest financial tools and technologies available, businesses can significantly streamline their operations, optimize efficiency across various financial processes, and enhance overall financial management capabilities.

Online and Mobile Banking

Securely manage transactions, transfer funds, pay bills, and monitor finances from home or on the go. This convenience saves time, reduces bank visits, and allows efficient financial control anytime, anywhere. Enhanced security features also ensure peace of mind for online transactions.

Accounting Software Integration

Many banks now provide seamless integration with popular accounting software such as QuickBooks or Xero. This integration not only simplifies financial management but also enhances efficiency, reduces manual errors, and enables timely decision-making based on up-to-date financial information. Embracing this technology can empower businesses to focus more on growth and less on administrative tasks, ultimately driving productivity and competitiveness in the marketplace.

Cash Flow Management Tools

Utilize tools provided by your bank or third-party services to track and forecast your cash flow. These tools provide detailed insights into the timing and movement of your funds, helping you to anticipate liquidity needs, manage expenses, and optimize financial decision-making.

Building a Relationship with Your Banker

Establishing a strong relationship with your bank and its representatives can be a significant asset, providing you with personalized service, access to tailored financial advice, and potential opportunities for favorable terms on loans and other financial products. This rapport can also lead to quicker issue resolution and a deeper understanding of your unique financial needs and goals, ultimately enhancing your overall banking experience and financial well-being.

Personalized Advice

A good banker can offer insights specifically tailored to your business’s unique needs and challenges, ensuring that the guidance you receive is relevant and effective. This personalized advice can help you navigate complex financial decisions, optimize your cash flow, and identify growth opportunities. By understanding the nuances of your business, a knowledgeable banker can recommend strategies that align with your objectives and help you achieve long-term success.

Access to Resources

Banks often offer additional resources, such as workshops, networking events, or business planning tools. These resources can help you stay informed about the latest industry trends, connect with other business professionals, and develop comprehensive strategies for growth and success.

Easier Access to Credit

A strong relationship can make it easier to secure loans or lines of credit when you need them. By understanding your business and its financial health, your banker can advocate on your behalf, offering more favorable terms and quicker approval times. Ultimately, this relationship can be a critical factor in ensuring that your business has the financial resources it needs to thrive.

Final Thoughts

Understanding the world of small business banking can feel overwhelming, but with the right knowledge and resources, it becomes achievable and advantageous. Begin by choosing the right bank, understanding the different account options, and maintaining a distinction between your personal and business finances. Embrace the available technology and establish strong connections with your banking associates. By doing this, you will establish a sturdy financial base for your business, enabling it to expand and prosper.

Whether you’re just starting or looking to optimize your existing setup, these fundamental banking steps are crucial for achieving financial success. Happy banking!